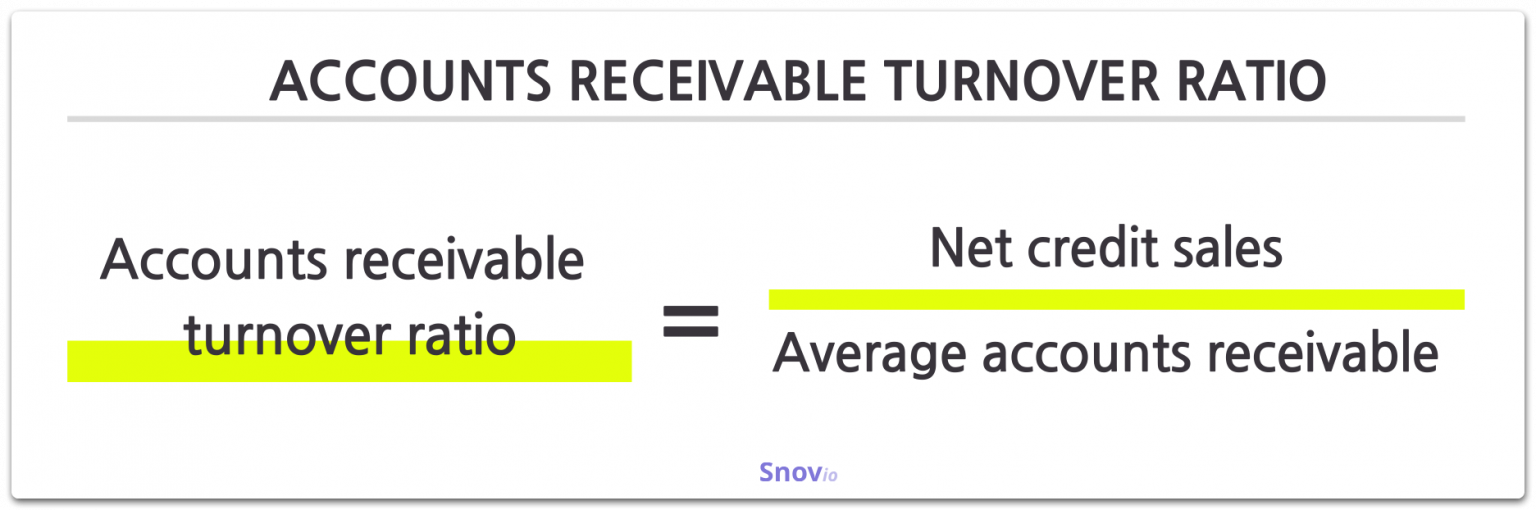

This ratio gives the business a solid idea of how efficiently it collects on debts owed toward credit it extended, with a lower number showing higher efficiency. Deeper definitionĪccounts receivable turnover is described as a ratio of average accounts receivable for a period divided by the net credit sales for that same period. Accountants and analysts use accounts receivable turnover to measure how efficiently companies collect on the credit that they provide their customers.

What to do when you lose your 401(k) matchĪccounts receivable turnover is the number of times per year that a business collects its average accounts receivable. Should you accept an early retirement offer? Additional ResourcesĬFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst.How much should you contribute to your 401(k)? The CTR is best used if the company’s cash balance year-over-year does not see significant changes. Using the cash turnover ratio for companies that offer credit sales skews the CTR by making it larger than it really is.Īdditionally, accumulating cash for future acquisitions skews the cash turnover ratio lower. The cash turnover ratio is most appropriate for companies that do not offer credit sales. The key drawback of the cash turnover ratio is that it does not account for credit sales, which are sales made by customers in which the payment is delayed. This formula is as follows:įor example, if a company reports a cash turnover ratio of 2, the days it takes for cash replenishment would be 365 / 2 = 183. Days Cash ReplenishmentĮxtending the cash turnover ratio by dividing 365 by the CTR provides the number of days, on average, that it takes for a company to replenish its cash balance. As with other ratios, it should be compared to competitors and industry benchmarks. However, it is important to note that there is no one ideal cash turnover ratio number. Additionally, the cash turnover ratio is often used by accountants for budgeting purposes.Ī higher cash turnover ratio is desirable, as it indicates a greater frequency of cash replenishment through revenue.

The cash turnover ratio indicates how many times a company went through its cash balance over an accounting period and the efficiency of a company’s cash in the generation of revenue. Therefore, the company’s cash management marginally improved year over year.

The following is a partial balance sheet and income statement of the company: It is currently 2014 – John is a business owner looking to gain a better understanding of his company’s cash management on a trended basis (2013-2014) by using the cash turnover ratio. The cash turnover ratio is ideal for companies that do not offer credit sales.The cash turnover ratio is calculated as revenue divided by cash and cash equivalents.The cash turnover ratio is an efficiency ratio that reveals the number of times that cash is turned over in an accounting period.

0 kommentar(er)

0 kommentar(er)